Annual Asset Class Returns • Novel Investor

L' asset allocation è il processo con il quale si decide in che modo distribuire le risorse fra diversi i possibili investimenti. Le principali categorie di investimenti entro cui si orienta.

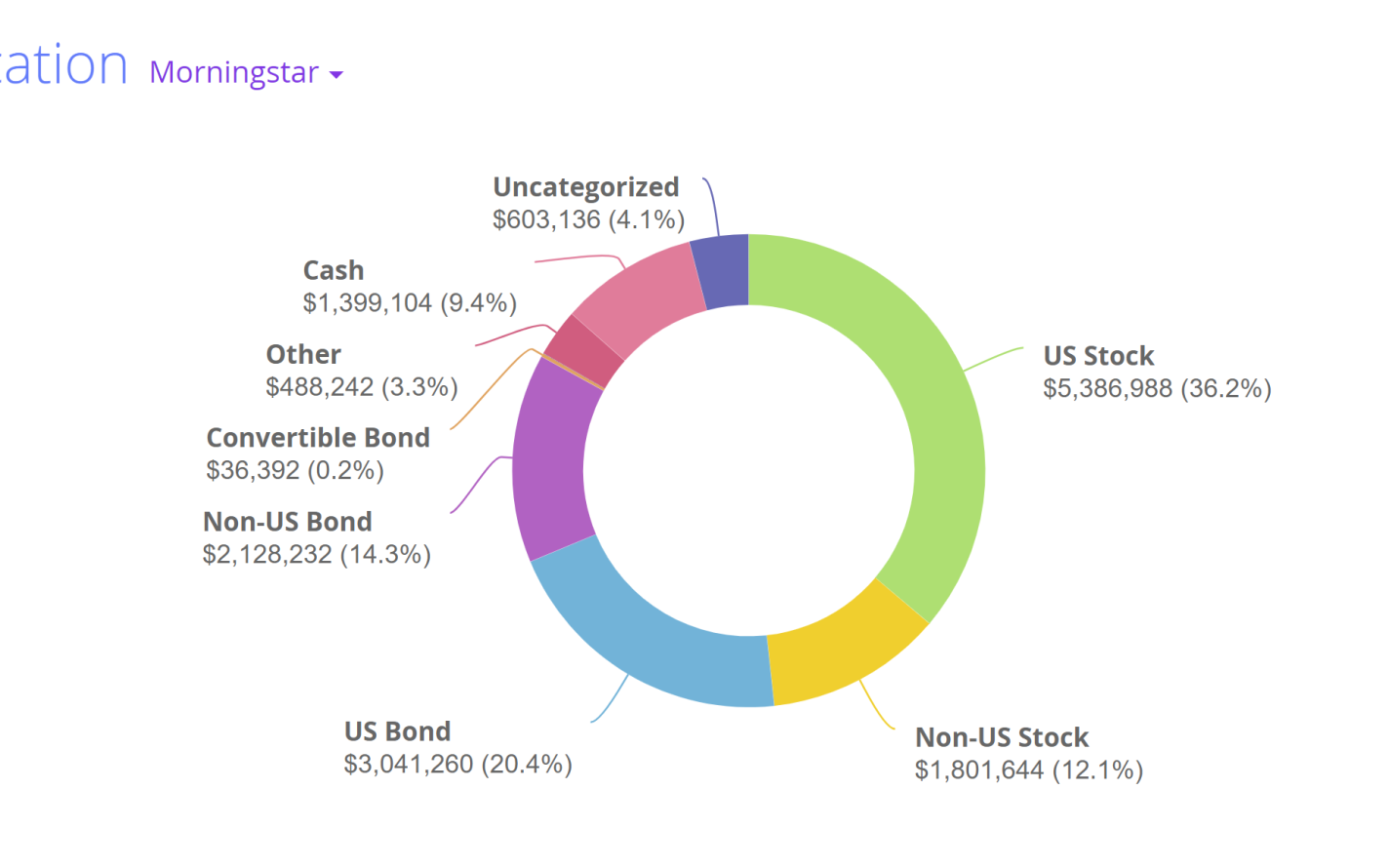

Investment Asset Allocation San Angelo Area Foundation

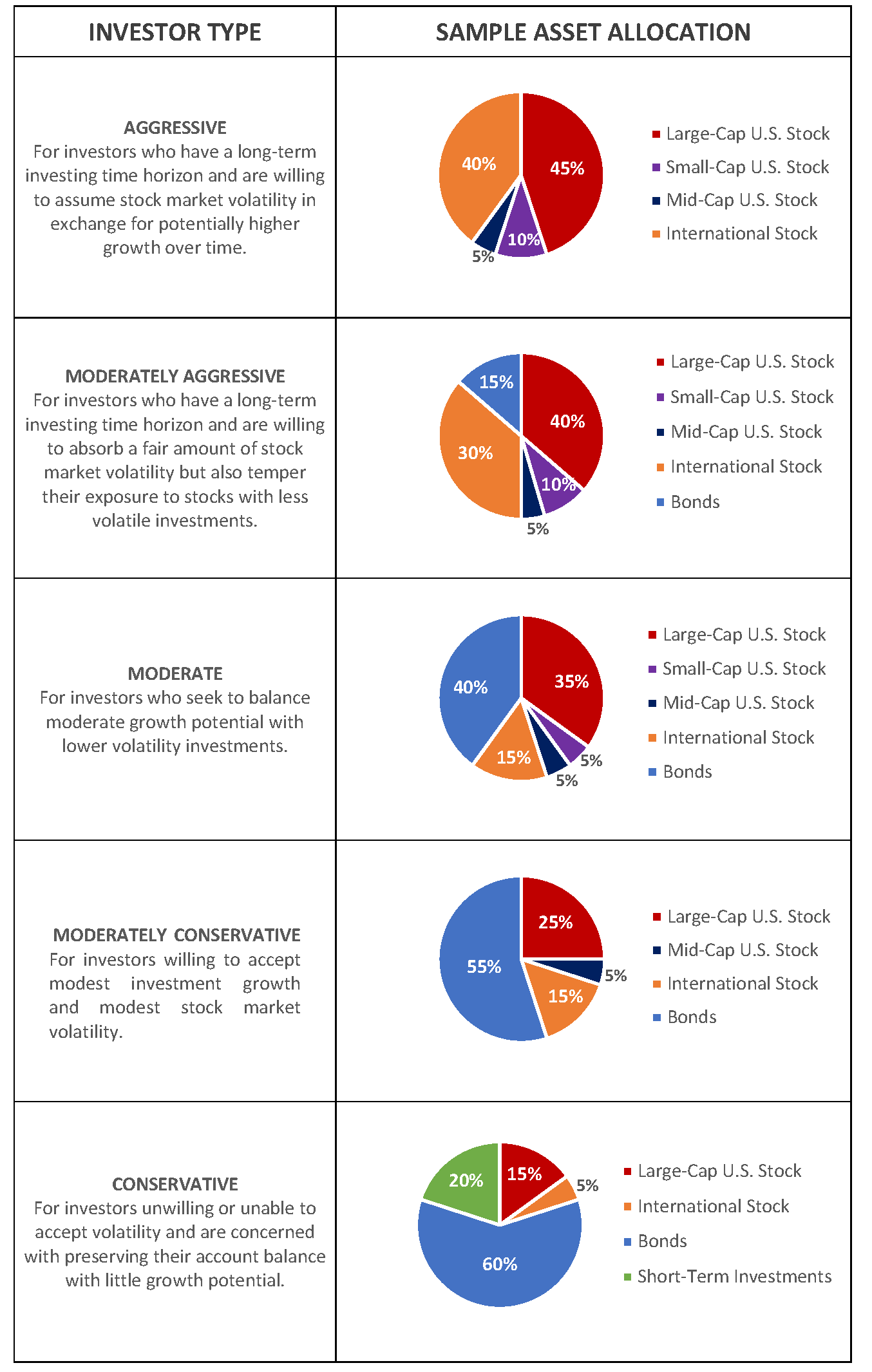

Asset allocation is the process of dividing the money in your investment portfolio among stocks, bonds and cash. When people gamble on sports, they generally bet all their money on one team. If.

Asset Allocation Features Capitect

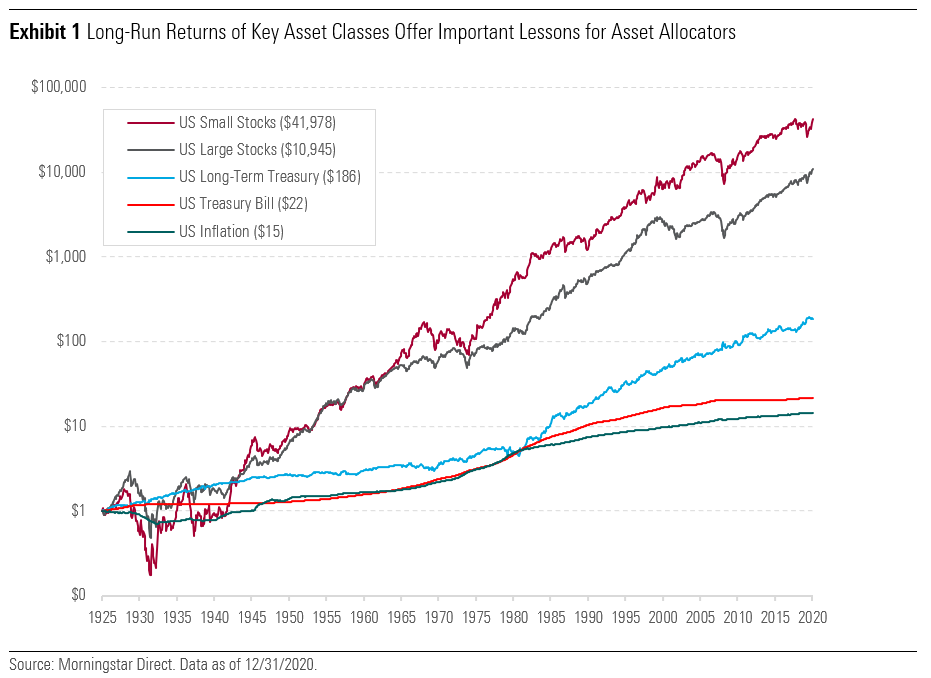

Key Takeaways. Your ideal asset allocation is the mix of investments, from most aggressive to safest, that will earn the total return over time that you need. The mix includes stocks, bonds, and.

Asset allocation pie chart graph financial Vector Image

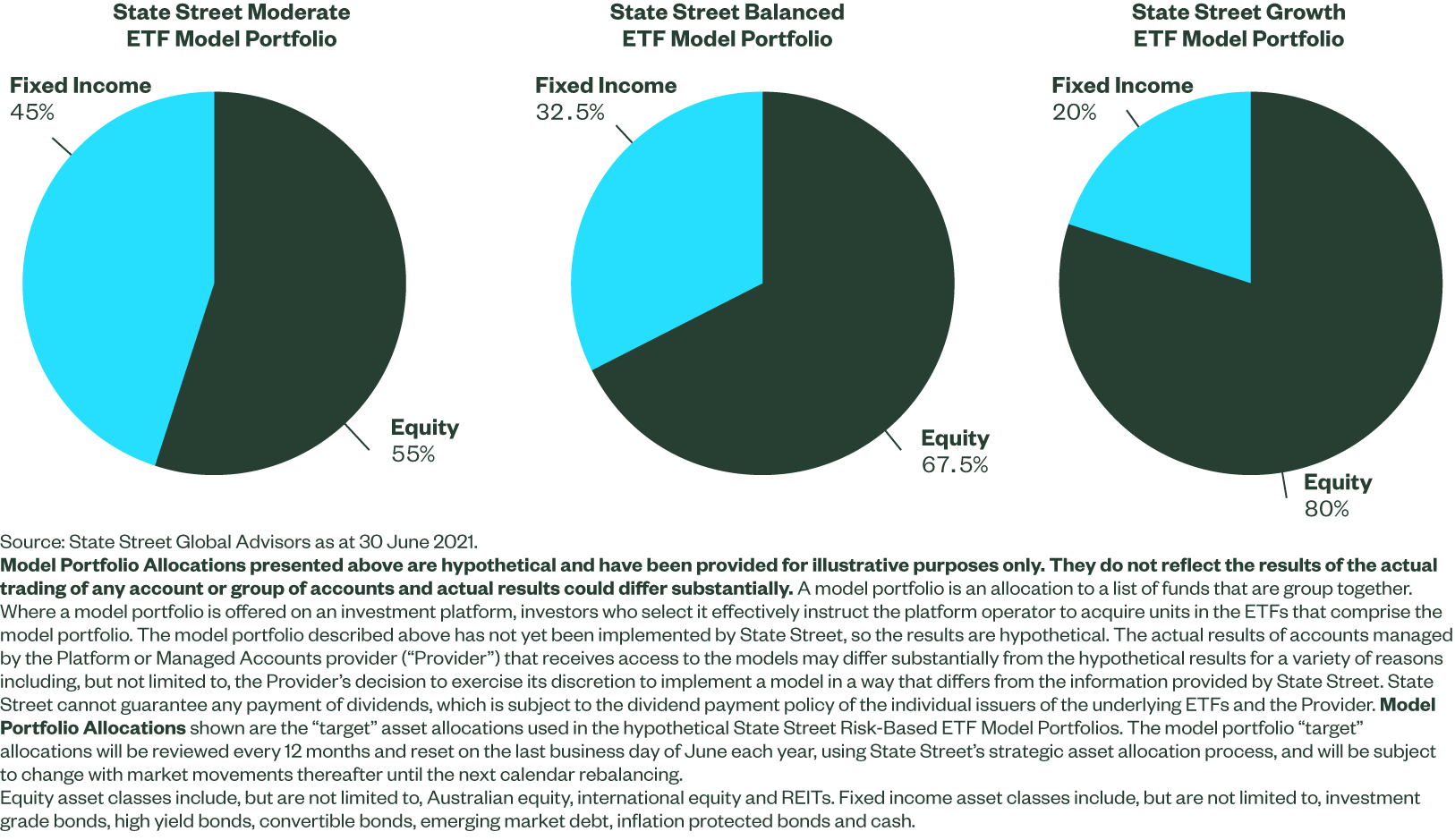

Adam Millson Feb 8, 2024. Model portfolios continue to gain traction with financial advisors. Approximately $424 billion follows model portfolios as of June 2023, a 48% increase from $286 billion.

Content Asset Allocation Strategies For Content Marketers

This study develops three capital allocation approaches and a directional weight increment algorithm to identify the efficient frontier of all possible multi-asset portfolios precisely and rapidly. Subsequently, this study proposes an asset selection criterion, based on the coefficient of variance and volatility risk measures, to perform the asset allocation for two types of investors who are.

Asset Allocation Strategy Minnesota State Retirement System (MSRS)

We consider the dynamic version of these dual considerations Asset-Allocation and Consumption decisions at each time step Asset-Allocation decisions typically deal with Risk-Reward tradeo s The broad topic is Investment Management Applies to Corporations as well as Individuals The two considerations are: How to allocate money across assets in.

The Ins and Outs of Asset Allocation Weatherly Asset Management

TD Ameritrade includes IShares asset allocation etfs under commission free. Expense ratio is 0.25%. One advantage of this product is one can buy and sell as a whole unit. It will be nice if you.

Beginners' Guide On What Is Asset Allocation? Importance & Strategy

Cover On Approach: The closing out of a profitable short position as the security moves toward a key level of support. As a security moves closer to a level of support the chances of it falling.

Asset Allocation Explanation, Its Strategies, Importance

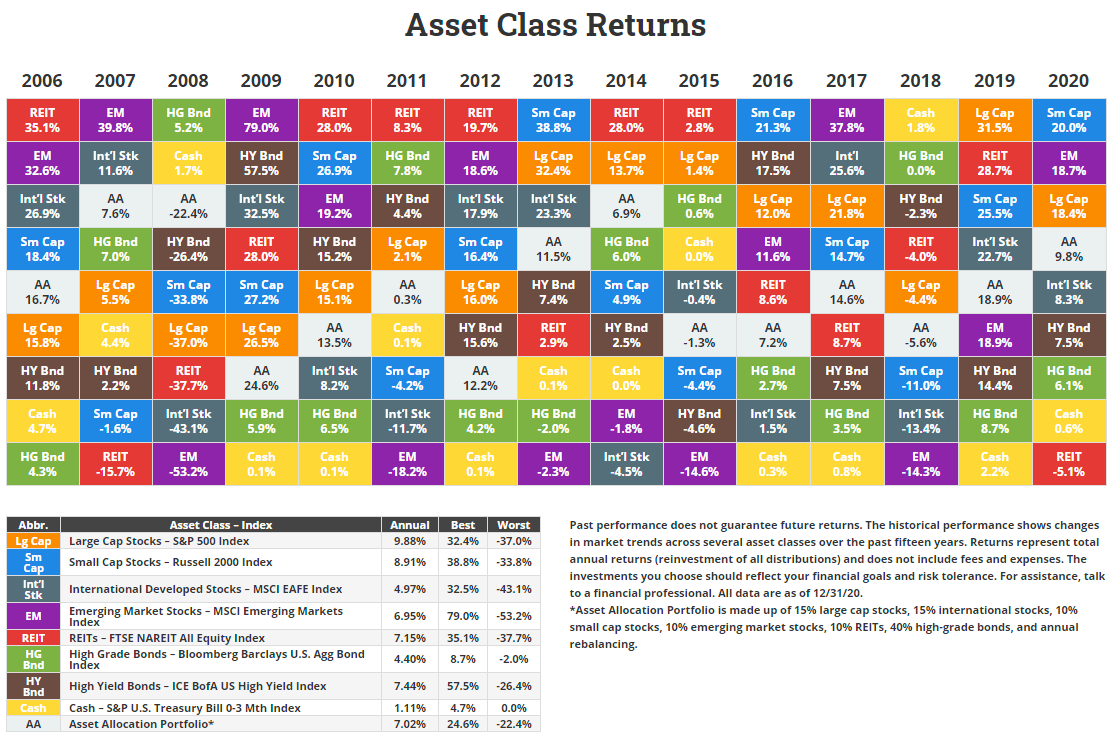

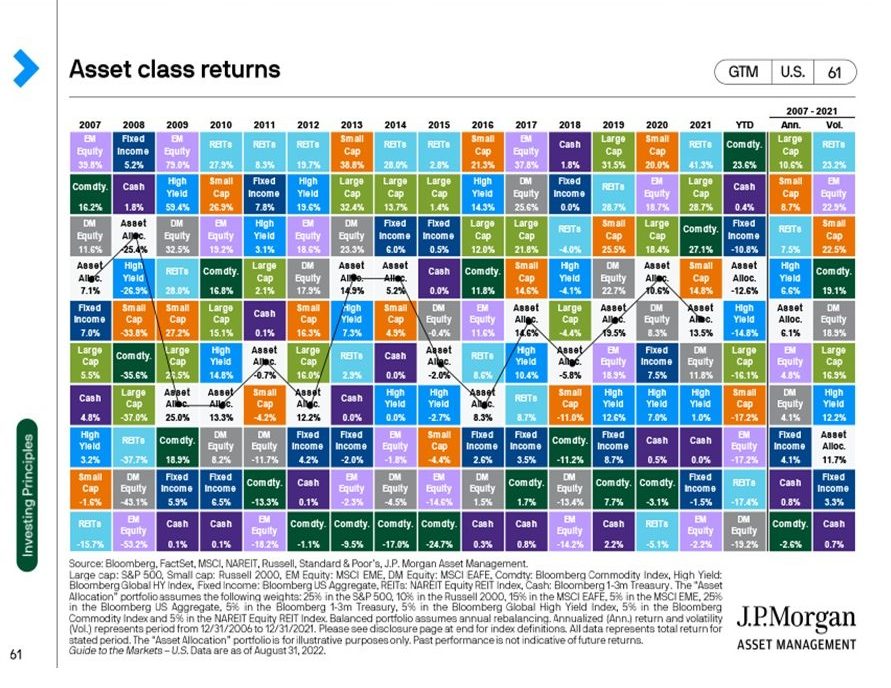

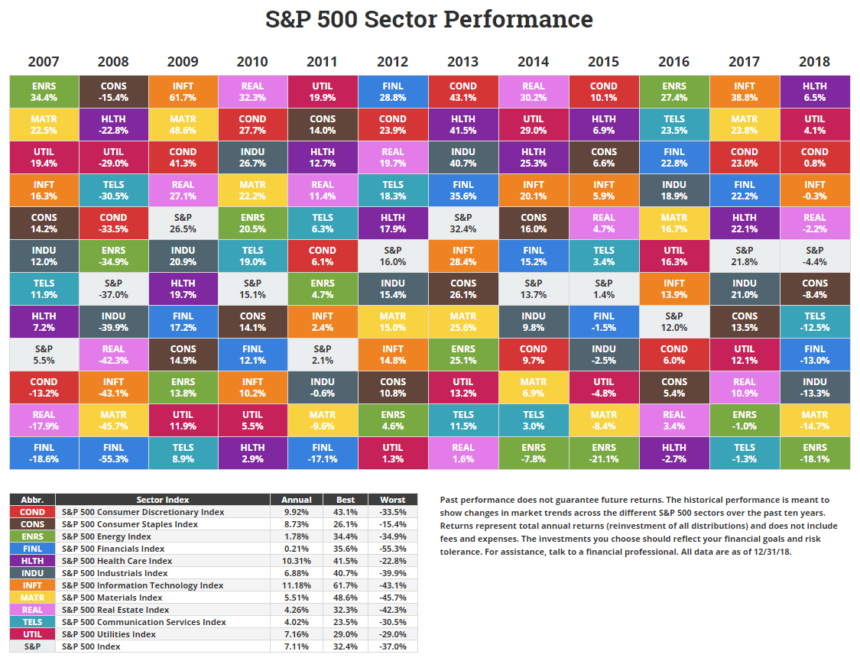

The wide performance swings over the past several years demonstrated a key principle of asset allocation 1 — that asset returns and their rankings varied from year to year — but historically, over multiple-year time periods, asset-class performance has tended to smooth out.; A diversified allocation is designed in an effort to help reduce volatility over multiple-year time periods, but it.

Asset Allocation Enrichwise

Anderson et al. report that risk parity strategies perform well and usually even outperform 1/N, value-weighted or 60/40 portfolios.The risk parity approach exploits the low-volatility anomaly, according to which low-volatility assets usually earn a higher premium per unit of volatility than high-volatility assets (Baker et al. 2011; Frazzini and Pedersen 2014).

Asset Allocation Quilt 20112020 Money Musingz Personal Finance Blog

The S&P DTAQ is a global, systematic, multi-asset allocation strategy that employs trend following, volatility, and economic activity signals to determine asset class allocations. a weight of 85%, divided into three regions: U.S., international, and emerging markets. a 0% weight in the base allocation.

The Virtues of Asset Allocation [Chart]

Quantitative analysis that considers market inefficiencies, intra- and cross-asset class models, relative value and market directional strategies; Strategy Summits and ongoing dialogue in which research and investor teams debate, challenge and develop the firm's asset allocation views; As of December 31, 2023

Historical Returns by Asset Class for Asset Allocation Why to invest in Momentum

This paper proposes a practical investment framework for a dynamic asset allocation strategy based on changes in economic regimes and investigates whether the regime-based dynamic approach produces better long-term results than the static approach. We begin by constructing monthly growth and inflation indicators that track the US economic.

Best and worst asset classes in 2021 Mint

The objective of the portfolio manager is to beat the strategic benchmark's performance by taking allocation (asset classes, countries, and duration for bonds) and selection (stock, funds and bond picking) decisions. In order to beat the benchmark those decisions are of 3 types: be underweight, in line or overweight the different asset.

5 Lessons From 5 Decades of Asset Allocation Institute

Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. We use historical returns and standard deviations of stocks, bonds and cash to simulate what your return may be over time. We use a Monte Carlo simulation model to calculate the expected returns of 10,000 portfolios for each risk profile.

What is Strategic Asset Allocation?

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance and investment horizon . The.

- Si Lega Ai Suoi Capi

- Come Funziona Il College In America

- Mitico E Famoso Re Di Cipro

- Google Play Games For Pc

- Antonio Faiella Febbre Da Cavallo

- Una Pallina Di Gomma Viene Lanciata Due Volte

- Voi Ch Ascoltate In Rime Sparse Il Suono Analisi

- Un Ottimo Prodotto Suino Della Zona Di Carrara

- God Of War Ragnarok Svartalfheim

- Roma Mausoleo Di Santa Costanza