PPT Chapter 13 PowerPoint Presentation, free download ID315987

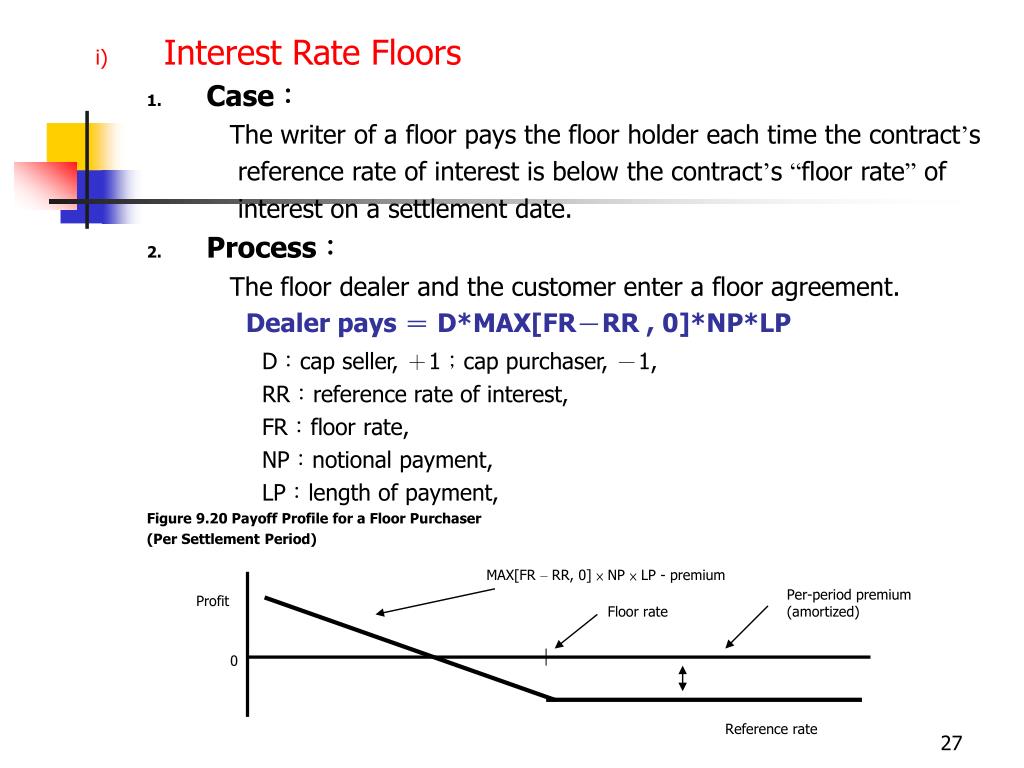

Interest Rate Floor: An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product. Interest rate floors are utilized in derivative.

INTEREST RATE CAP, FLOOR & COLLAR CA FINAL SFM & CS PROFESSIONAL FTFM YouTube

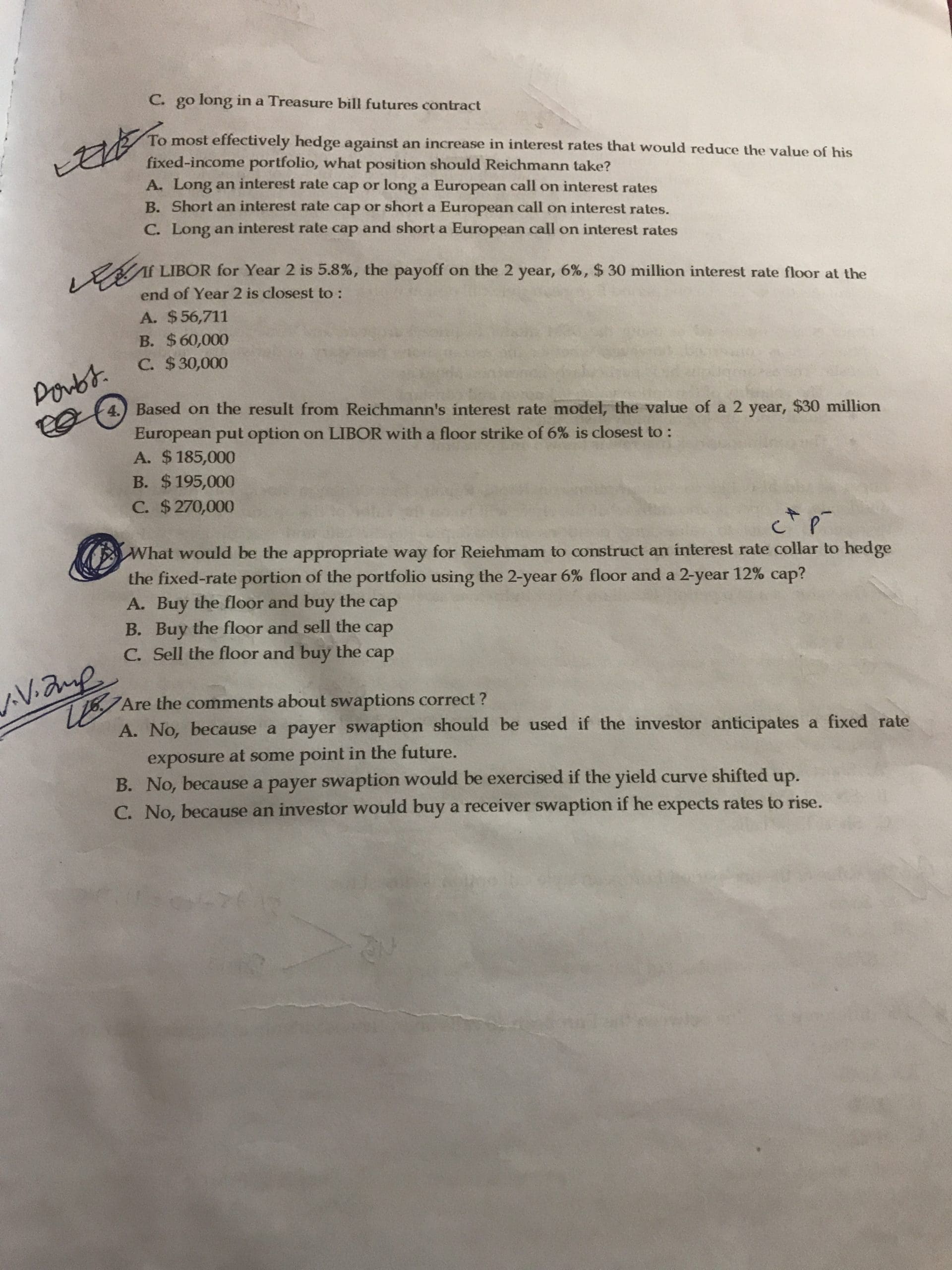

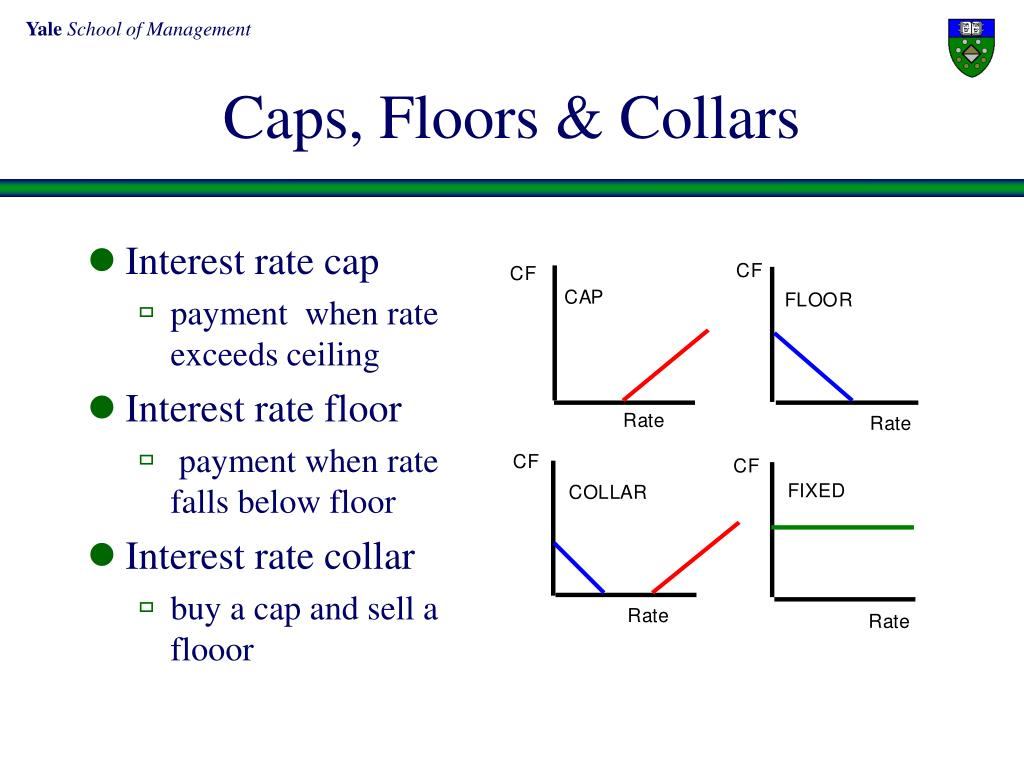

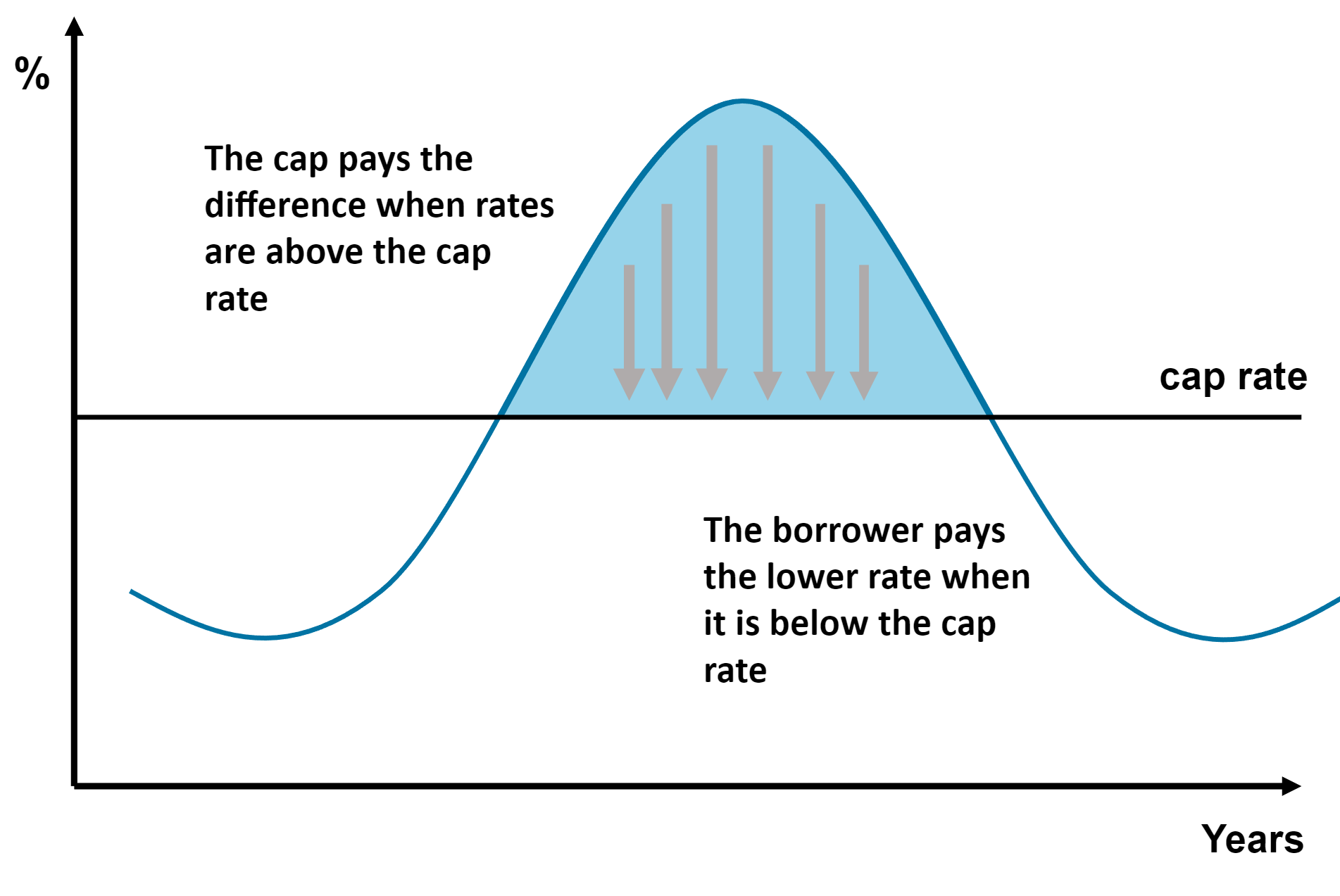

In contrast to an interest rate floor, an interest rate cap limits how much it can rise on a variable loan. Sometimes, a cap is called an interest rate ceiling. In combination, an interest rate floor and interest rate cap credit an interest rate collar that limits the upward and downward swings.

Interest rate cap and floor SSEI QForum

The interest rate cap can specify the maximum interest rate annually and over the life of the loan. There are three different types of interest rate caps: the initial cap, subsequent cap, and lifetime cap. In comparison, the interest rate floor is the lowest possible rate you can receive on a variable loan product.

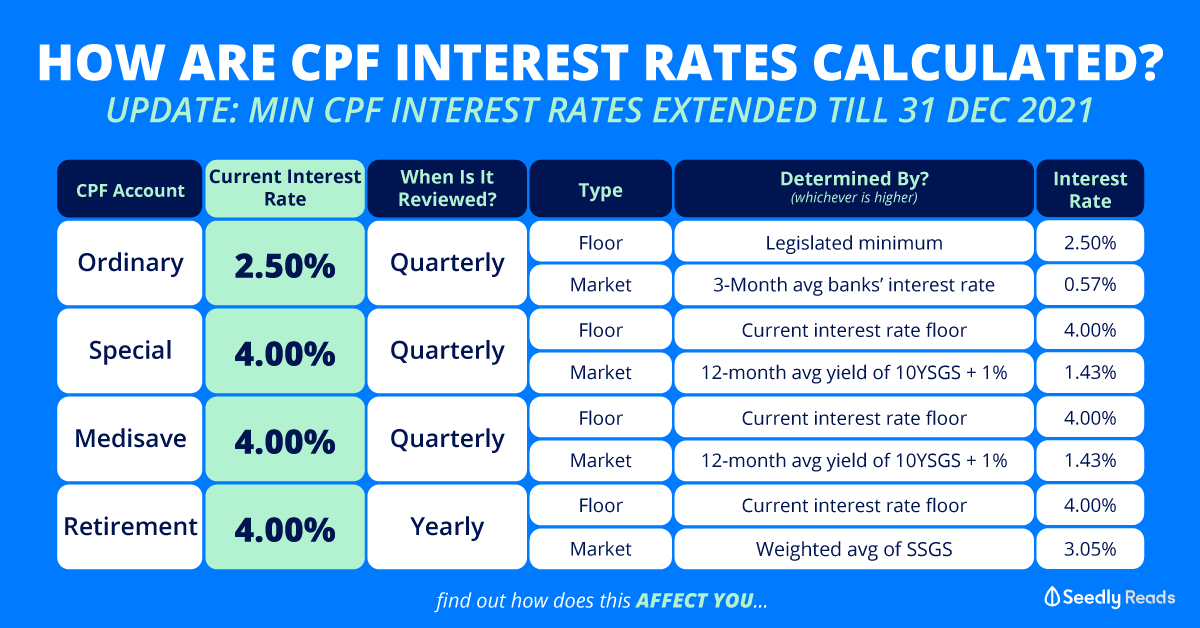

CPF Interest Rates Minimum 4 on Special, MediSave, and Retirement Accounts Extended Till 2021

In other words, Cap - Floor = Swap. From the pricing examples above, we see that this value is. 408.33-669.22 =-260.89. Calculating an interest rate swap, with fixed rate equal to the strike of 12.5%, notional =100,000, payment frequency = annual and payment dates similar to that of the cap and floor above we see that the value of the swap is.

Understanding Cap Rates and Interest Rates Gray Capital LLC

Definition. An is the lowest interest rate you can receive on a loan product that has a variable rate. Interest Rate Floor. Interest Rate Cap. The minimum interest rate a borrower can be charged on a variable-rate loan product. The maximum interest rate a borrower can be charged on a variable-rate loan product. Reduces the risk to the lender.

What Is Interest Rate Cap And Floor Viewfloor.co

The Difference Between Interest Rate Floor And Interest Rate Cap. Now that we've defined an interest rate floor, what is an interest rate cap, in contrast? Let's say you have a 7/6 ARM. Several factors impact 7/6 ARM rates, including the index it's attached to, the margin, interest rate floors and caps as well as intervals. In this example, the.

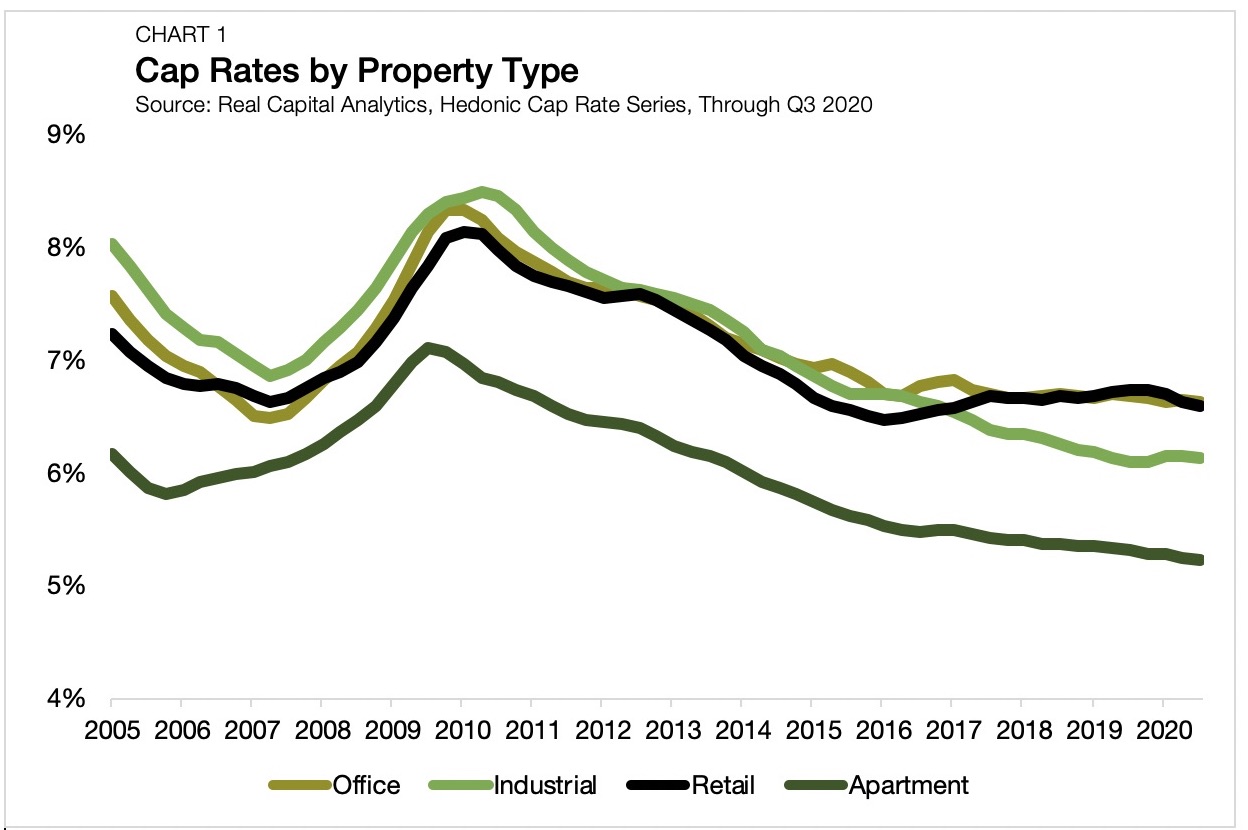

Cap Rate vs Borrowing Cost A 10 Year Review February 2019

For instance, consider a loan assessed at a rate of 1-Month LIBOR + 1.50% with an interest rate ceiling of 4% and a floor of 2%. If 1-Month LIBOR falls to 0.25%, the calculated rate would be 1.75%. However, this rate falls below the floor, triggering the floor rate of 2%.

How Resilient Are Apartment Cap Rates in a Crisis? Arbor Realty

Based on the initial adjustment rate cap of 2%, the interest rate can only change by 2%. For example, if the initial fixed-rate was 4%, the new interest rate could be as high as 6%. Next up, the subsequent adjustment rate cap of 2% means that later interest rate changes can only swing 2%.

PPT C) Option markets and contracts PowerPoint Presentation, free download ID5880824

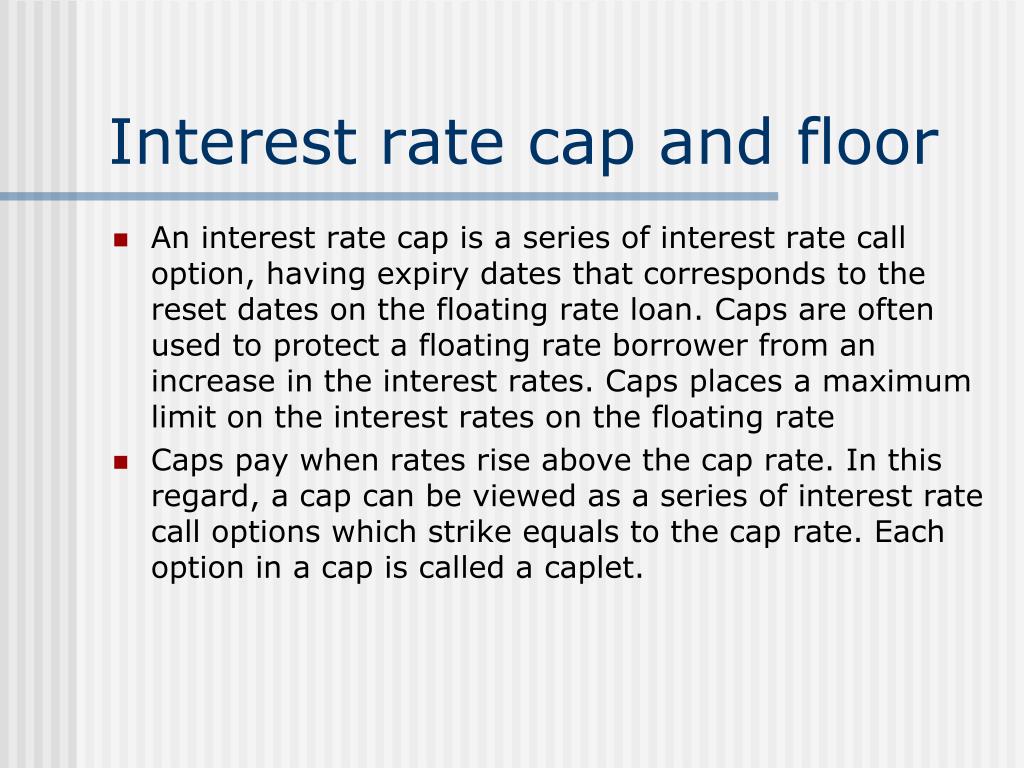

Interest rate cap and floor An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to receive a payment for each month the LIBOR rate exceeds 2.5%.

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

Zero Floor Interest Rate Meaning Viewfloor.co

An interest rate swap and floor is a combination of an interest rate swap with the purchase of an interest rate floor. By entering into the swap, the borrower agrees to pay a pre-agreed fixed rate of interest in return for a floating rate. By purchasing a floor, the borrower acquires the opportunity to benefit if the floating rate falls below.

Interest Rate Cap CapIt

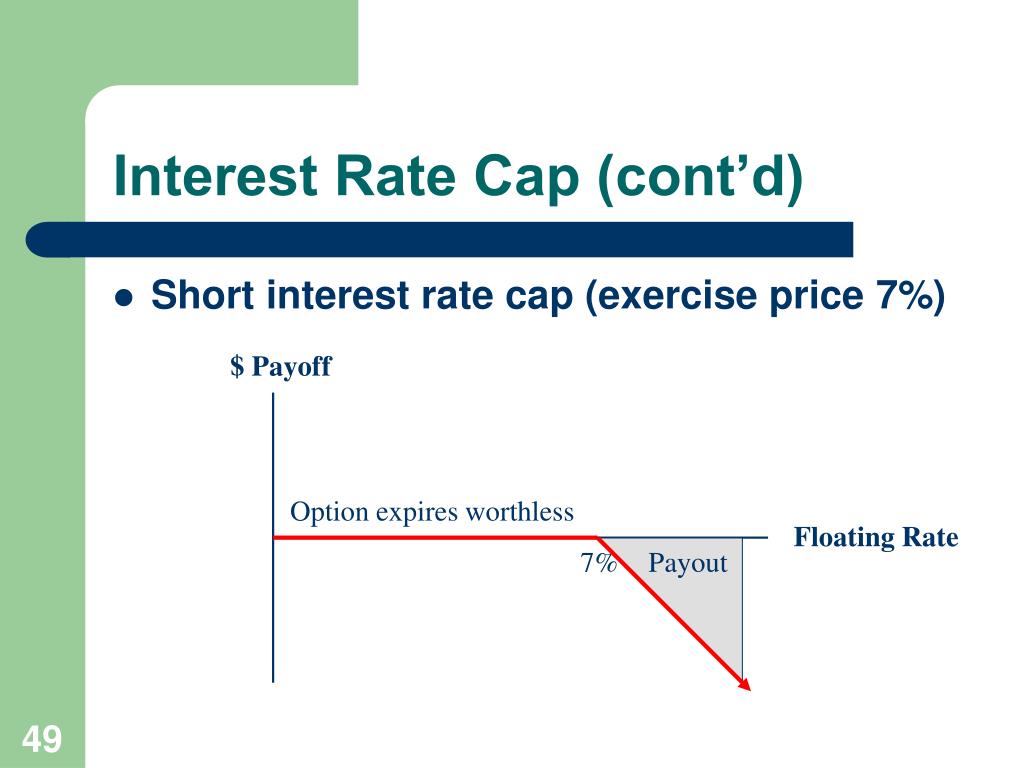

Cap/Floor Valuation. An interest rate cap is an OTC derivative where the buyer receives payments at the end of each period when the interest rate exceeds the strike, whereas an interest rate floor is a similar contract where the buyer receives payments at the end of each period when the interest rate is below the strike. 1.

Urbanomics Analyzing interest caps on MFIs

Interest rate caps, floors, and collars are financial instruments used to manage interest rate risk in various financial transactions, such as loans, mortgages, and bonds. An interest rate cap is a contractual agreement between a borrower and a lender that limits the maximum interest rate that the borrower will pay.

How Interest Rate Floors Work? Finance Train

Summary. Interest rate floors are generally a contract between two parties that provide a floor on floating-rate payments. When traders or borrowers seek to understand their downside limit, the interest rate floor can help them understand the level of risk they are taking on and its limits. Understanding at what value the floor should be set is.

What is APR? An APR vs. interest rate explainer TrendRadars

Estimate your costs of hedging floating rate debt with Chatham's interest rate cap pricing calculator. Simply enter the notional amount, term, and cap strike price for indicative pricing.

PPT Chapter 6 PowerPoint Presentation, free download ID4792555

Example #1. The interest cap premium formula is as follows: Interest Premium = (Index Level - Strike Price) x (Days in Period / 360) x (Notional Amount) Now let us assume that Freddy takes a home loan and negotiates a cap with a 6% strike rate.

:max_bytes(150000):strip_icc()/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

Volatilidade do ponto de vista do investidor Economia e Negocios

Interest rate cap and floor. In finance, an interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to receive a payment for each month the LIBOR rate exceeds 2.5%.

- San Prospero Borgo Valsugana 2023

- Cosa Caratterizza Un Appalto Pubblico Di Forniture

- Capitalizzazione Semplice E Composta Formule

- 01020 San Lorenzo Nuovo Vt

- Navi Italiane In Medio Oriente

- Macchie Arancioni Sulle Mani Cause

- Quanti Sono I Senatori A Vita

- Pesci Tropicali Acquario Acqua Dolce

- Theodore Alvinnn And The Chipmunks

- Macrogol 4000 Dopo Quanto Fa Effetto